Mutual Fund is a vehicle that enables a collective group of individuals to:

Pool their investible surplus funds and collectively invest in instruments / assets for a common investment objective.

Optimize the knowledge and experience of a fund manager, a capacity that individually they may not have

Benefit from the economies of scale which size enables and is not available on an individual basis

Investing in a mutual fund is like an investment made by a collective. An individual as a single investor is likely to have lesser amount of money at disposal than say, a group of friends put together.

he Asset Management Company (AMC) invests the investors’ money on their behalf into various assets such as stocks, bonds, money market instruments while the SEBI and the Board of Trustees regulate the Mutual Funds.

The classification of mutual fund schemes can be on the basis of:

Time Horizon

Open ended funds

Close Ended funds

Asset classes

Equity funds

Debt funds

Hybrid funds or Income funds

Real estate funds

Gold funds

Investment PhilosophyDiversified Equity funds

Sector funds

Index funds

Exchange traded funds (ETFs)

Fund of funds (FOF)

Fixed Maturity Plan (FMP)

Arbitrage funds

The investments in Mutual funds can be done via the lump sum or Systematic Investment Plan (SIP) route.

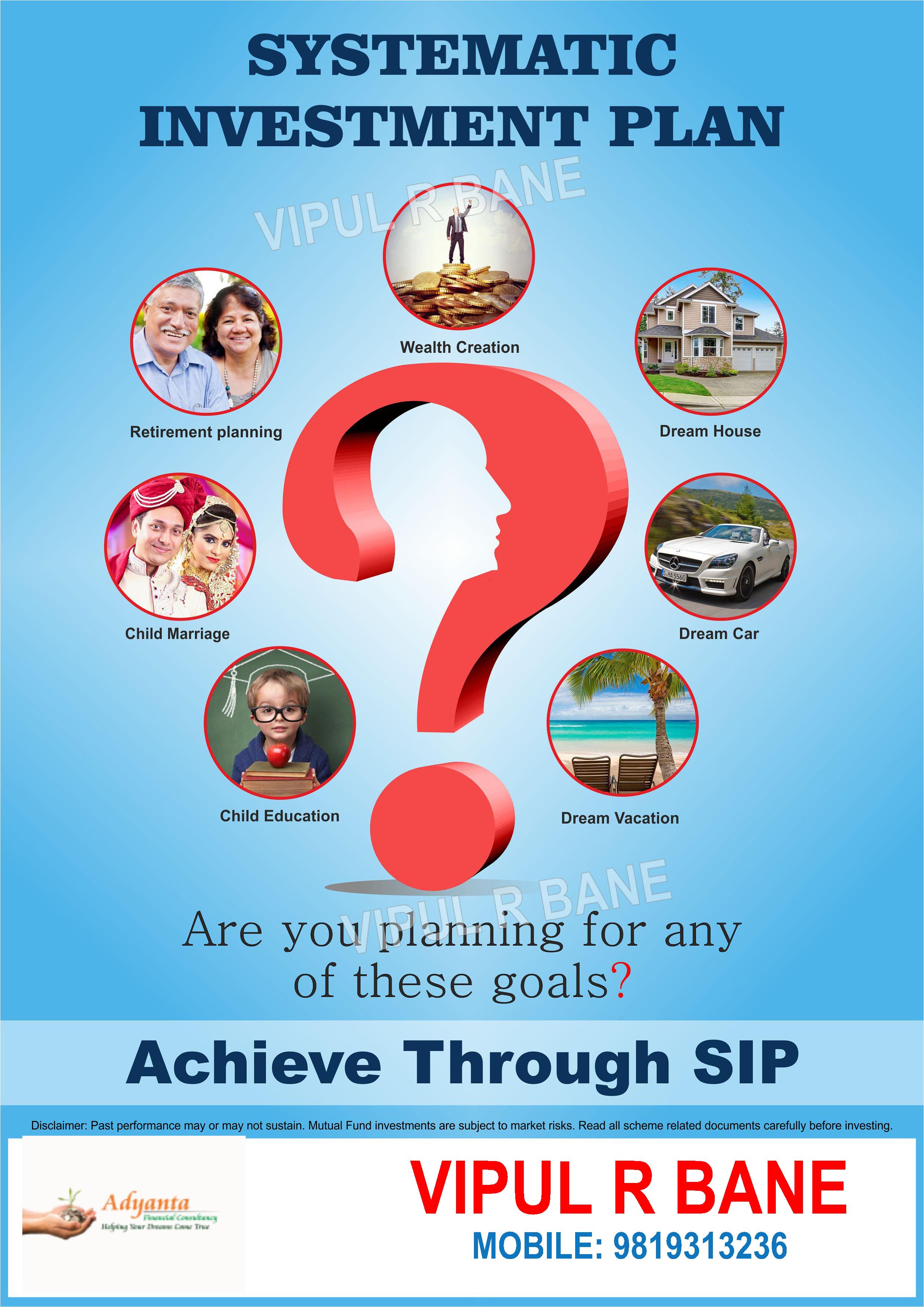

Systematic Investment Plan (SIP) has its inherent benefits like rupee cost averaging, easy on pocket, generating long-term return which beats inflation and many more. But what are unique to SIP are the unmatched flexibilities that it offers in form of Regular, Limited-period and Step-up SIP.

Key benefits of investing through SIP:

Brings financial discipline in life

Timing risk is eliminated

Power of compounding

Can be started with small amount

Achieve goal in a painless manner

Flexibilities that SIP offers:

Goal Name: Retirement; Target Corpus: Rs.3.60 Cr (Approx.); Monthly Expenses: Rs.50,000/-

Current Age: 40 Years; Retirement Age: 60 Years; Life Expectancy: 80 Years

Inflation: 7%; Return Till Retirement: 13%; Return Post Retirement: 10%

| Type of SIP | SIP Amount (Rs) | Years of Investment | Future Value (Rs) |

|---|---|---|---|

| Limited Period SIP | 44,878 | 10 | 3.60 Cr |

| Regular SIP | 34,666 | 20 | 3.60 Cr |

| Step-up SIP | 16,608 | 20 | 3.60 Cr |

Limited Period SIP : SIP investment of same amount is done for a certain period and then that is held for the remaining period; in the above example SIP of amount Rs.44,878 is done for first 10 years and then the investment amount was held for another 10 years.

Regular SIP: SIP investment of same amount is done for the entire period; in the above example it is SIP of fixed amount of Rs.34, 666/- for 20 years.

Step-up SIP : After every one year SIP instalment amount increases by a prefixed amount or percentage; in the above example SIP of amount Rs.16,608 is done for the first year, then for next year SIP amount was Rs.18,269 which is Rs.1,661 or 10% higher than the previous year. This continues for the entire period.

How does SIP work?

Every month a specified amount is auto debited from investor’s bank account and invested in selected mutual fund scheme.

Units will be allotted every time the amount is invested, based on the NAV of the scheme.

Investor can redeem or switch out units partially or fully, anytime he/she wishes to do so.

Each SIP instalment is considered as a new investment; hence exit load will be applicable if you redeem your investment within the predefined time.

To achieve Your Financial/Investment Goals through Mutual fund investments or get a FREE 2nd opinion i.e Review & Analysis Report from an expert about your existing MF portfolio, please feel free to Contact us.